1956 Crore credit potential for Hamirpur district for 2025-26

ADM launched the Potential Linked Credit Plan (PLP) for 2025- 26 for the Hamirpur District

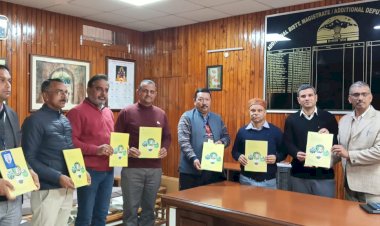

In a major event today, Additional District Magistrate, Hamirpur Shri Rahul Chauhan, HAS unveiled and launched the Potential Linked Credit Plan (PLP) for 2025-26 for Hamirpur District. PLP is prepared by NABARD and contains credit potential for various sectors under the Priority Sector Lending programme. It assesses the likely potential of credit offtake to these sectors. The plan focuses on fostering sustainable economic growth in Hamirpur district by boosting financial support to key sectors, including agriculture, micro, small, & medium enterprises (MSMEs), and social infrastructure.

For the year 2025-26, the credit potential has been valued at includes allocation of 745.03 Crore for the agriculture sector, MSMEs, and 223.24 Crore for the sectors such as education, energy, social infrastructure etc. 1956 Crore which 987.72 Crore for housing, renewable

PLP also highlights the sector-specific infrastructure gaps and critical interventions required to be made by the State Government and financial institutions to harness the potential available under the priority sector. PLP will be a catalyst for empowering Rural India and serving the needs of all stakeholders in the rural ecosystem.

The credit projections for the year 2025-26 have been fixed taking into account the directions by the Reserve Bank of India for priority sector lending (PSL), the national & state priorities as well as additional potential created through completed infrastructure projects. Impetus has been placed on the creation of long-term assets through investment credit which also supports the sustainability of short-term credit.

The projections outlined in the PLP will serve as a foundational guide for banks to intensify their lending activities tapping into the full potential of key priority sectors. The PLP will be of immense utility to all stakeholders.

The ADM emphasised the importance of banks and financial institutions in leveraging this document to meet the district's credit and development goals, urging collective efforts to turn these projections into measurable outcomes. He urged departments and banks to identify viable projects and organise awareness camps to educate farmers and entrepreneurs about various central and state government schemes in agriculture, MSME and other sectors.

DDM-NABARD, Lead District Manager, District Planning Officer, Deputy Directors & officials from line departments and major bankers were present during the launch event.

hillquest

hillquest